Two Wheels, No Worries: Finding Your Perfect Motorcycle Breakdown Cover

Why Motorcycle Breakdown Cover Matters for Every Rider

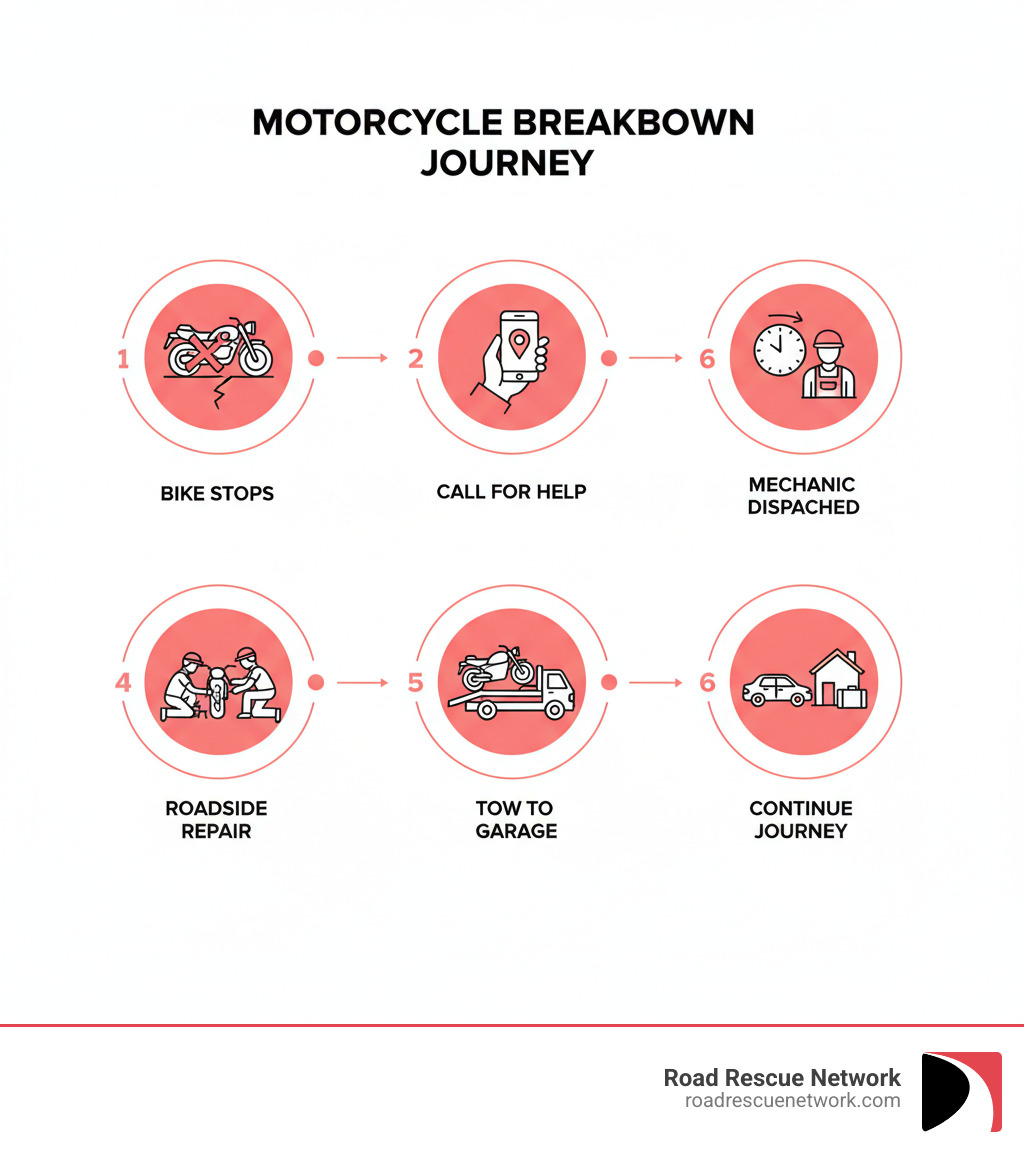

Motorcycle breakdown cover is a specialized roadside assistance policy that provides help when your bike experiences a mechanical failure, flat tire, dead battery, or other issue that leaves you stranded. It’s an essential safety net for any rider.

Typical Coverage Includes:

- Roadside Assistance: A mechanic is sent to your location for on-the-spot repairs.

- Recovery/Towing: Your bike is transported to a garage if it can’t be fixed roadside.

- Home Start: You get assistance if your bike won’t start at home.

- 24/7 Support: Help is available anytime you break down.

- Other Services: Fuel delivery, battery jumpstarts, and flat tire assistance are common.

There are two main types of policies: Personal Cover, which protects you as a rider in any eligible vehicle, and Vehicle Cover, which protects a specific motorcycle regardless of who is riding.

Nothing is worse than getting ready for a ride only to have your bike refuse to start, or breaking down on a busy highway. Adverse weather and long-term storage can lead to flat batteries and mechanical issues that strike at the worst possible time.

With hundreds of thousands of motorcycle breakdowns requiring professional assistance each year, having the right cover means you’re never left stranded. Whether it’s a snapped chain, punctured tire, or electrical fault, reliable motorcycle breakdown cover is crucial for riders who depend on their bikes for daily commutes or weekend adventures.

What’s Included? Services and Tiers of Cover Explained

When your bike suddenly refuses to cooperate, you need to know what help is coming. Motorcycle breakdown cover isn’t a single service—it’s a suite of options designed for different riding styles and budgets.

The goal is simple: get you and your bike moving again. In most cases, a skilled mechanic is dispatched to fix the issue on the spot. Many providers successfully fix a majority of bikes at the roadside. When a quick fix isn’t possible, they’ll arrange safe transport for your motorcycle.

What are the different types of motorcycle breakdown cover?

Not all riders need the same level of protection. That’s why motorcycle breakdown cover comes in distinct tiers.

-

Roadside Assistance is your entry-level option, focusing on fixing your bike where it stops. It’s perfect for riders who stay close to home.

-

Recovery builds on roadside assistance by adding transportation to a garage or your home when repairs can’t be completed on the spot.

-

Home Start (or At Home cover) addresses mornings when your bike won’t start in your driveway. For daily commuters, this feature is invaluable.

-

Onward Travel helps if your bike needs extensive repairs far from home. This may cover alternative transportation like a rental vehicle, taxi fare, or even overnight accommodation.

-

Key Cover is usually an optional add-on that handles replacement keys and locksmith services, which can be a significant cost saver.

What services are typically included?

When you invest in motorcycle breakdown cover, you’re securing a comprehensive support system.

The foundation is 24/7 support, so help is always a phone call away. Once you make contact, a mechanic is dispatched to your location. These specialists are equipped to diagnose and resolve common motorcycle issues.

The priority is always roadside repairs, including fixing flat tires, dealing with minor mechanical faults, and attempting battery jumpstarts. When a roadside fix isn’t possible, towing to a garage ensures your bike gets professional help safely.

Misfuelling assistance covers both wrong-fuel situations and running out of gas. The service delivers fuel to your location, and you just pay for the fuel itself. For battery problems, some plans go beyond a simple jumpstart and may assist with replacement.

Lost or broken key services provide real peace of mind by arranging for a locksmith or key replacement. Finally, alternative transport and accommodation ensure a breakdown doesn’t ruin your trip if you’re far from home.

Coverage typically extends to all road-legal two-wheelers, including mopeds, scooters, cruisers, and sport bikes. This flexibility means one policy can protect you across different types of bikes.

How to Choose the Right Motorcycle Breakdown Cover

Picking the right motorcycle breakdown cover is like choosing the right helmetit needs to fit your specific needs. There’s no universal solution, which allows you to find coverage that matches how you ride.

Your riding habits are the biggest factor. Daily commuters will find Home Start cover incredibly valuable for those mornings the bike won’t start. In contrast, long-distance tourers should prioritize national recovery and onward travel options to avoid being stranded far from home.

The age and type of your bike also matter. Most reputable providers cover vehicles of any age, from small mopeds to heavy cruisers. If you own a classic or custom motorcycle, you may want to look at more specialized policies.

Provider reputation is critical. When you’re stuck, you need to know help is coming. We recommend checking independent review platforms to see what real customers are saying. Look for providers with consistently high ratings and positive feedback on their response times and customer service. Sites like Trustpilot and the Better Business Bureau can help you gauge provider reliability and customer satisfaction.

When weighing your options, you’ll encounter a fundamental choice: personal cover versus vehicle cover.

| Feature | Personal Breakdown Cover | Vehicle Cover |

|---|---|---|

| What’s Covered | You as a person, in any eligible vehicle | A specific motorcycle, regardless of rider |

| Flexibility | Works whether you’re driving, riding, or a passenger | Only applies to the registered motorcycle |

| Best For | Multi-vehicle owners, frequent pillion passengers | Single bike households, bikes shared among family |

| Cost-Effectiveness | More economical if you use different vehicles | Better value if you only ride one specific motorcycle |

Personal vs. Vehicle Cover: What’s the Difference?

Personal cover protects you as an individual. It follows you whether you’re on your own motorcycle, riding as a passenger on a friend’s bike, or even driving a car. This flexibility is fantastic for riders who own multiple bikes or live in a household with various vehicles.

Vehicle cover is attached to your motorcycle’s registration. Anyone with permission to ride your bike is covered if it breaks down, but you won’t be covered if you’re riding someone else’s motorcycle. This works well for families who share a bike or for riders committed to one motorcycle.

Are Classic or Custom Motorcycles Covered?

If you ride a classic or custom motorcycle, you might wonder if standard motorcycle breakdown cover will protect it. The short answer is usually yes, but it’s worth checking the details.

Most modern providers cover vehicles of any age, so your classic bike is just as eligible for roadside assistance as a new model. For custom motorcycles, standard breakdown cover will still provide a tow or roadside help. However, if you’ve invested heavily in custom parts, you might want to look at additional “Custom Equipment” coverage through your motorcycle insurance policy, which is separate from breakdown cover but offers more comprehensive protection for your investment.

If you have a heavily modified bike, it’s always worth contacting providers directly to confirm that their recovery vehicles can safely handle your particular setup.

The Fine Print: Costs, Exclusions, and Insurance

Understanding the costs and limitations of motorcycle breakdown cover can save you from surprises when you’re on the roadside.

Breakdown cover is for mechanical failures, not for the aftermath of accidents, theft, or vandalism. If a mechanical issue causes a crash, the breakdown service handles the initial problem, but the subsequent damage falls under your motorcycle insurance.

Think of it this way: breakdown cover handles unexpected mechanical stops, while motorcycle insurance handles crashes and theft.

Most policies advertise “unlimited call-outs,” but they won’t cover the same recurring fault within a short period (typically 28 days). The policy expects you to repair your bike, not use recovery as a temporary fix.

Your bike must also be roadworthy. If you’ve been riding on bald tires or ignoring a serious mechanical issue, your claim may not be approved. Similarly, track days and off-road riding aren’t covered, as these policies are for legal road use only.

What are the typical costs of motorcycle breakdown cover?

The good news is that motorcycle breakdown cover is affordable, with quality coverage available for a low monthly cost. Pricing typically works in tiers, from basic roadside assistance to comprehensive packages that include recovery, home start, and onward travel.

To save money, buying online often provides significant discounts. If you own multiple vehicles, many providers let you cover them all under one policy at a reduced rate. Some motorcycle insurers also offer discounts if you bundle your breakdown cover with your insurance policy.

Reputable providers are transparent, so the price you see should be the price you pay, with no hidden fees when you make a claim.

How is it Different from Motorcycle Insurance?

Motorcycle breakdown cover and motorcycle insurance solve different problems. They are two essential layers of protection.

Breakdown cover is your lifeline for mechanical issues. A dead engine, a flat battery, or running out of fuel are all situations where breakdown cover helps. It’s all about getting you and your bike moving again when something mechanical goes wrong.

Motorcycle insurance, on the other hand, covers the financial fallout from accidents, theft, and liability. If you collide with a car, your collision coverage pays for repairs. If your bike is stolen, that’s comprehensive coverage. If you cause injury or property damage, liability coverage protects you financially.

Some insurance policies offer roadside assistance as an add-on, but it’s often more limited than dedicated breakdown cover. You might get basic towing but not the comprehensive mechanical support or other benefits of a proper breakdown policy. You really need both for complete peace of mind. For a neutral overview of typical coverages, see Motorcycle insurance.

Using Your Cover: Claims, Travel, and Tech

When your bike breaks down, knowing how to use your motorcycle breakdown cover can turn a stressful situation into a manageable one.

First and foremost, your safety comes first. Pull over to a safe spot, turn on your hazard lights, and get away from traffic. Only once you’re safe should you call for help.

The breakdown process is straightforward: you contact your provider, they dispatch assistance, and you either get fixed on the spot or towed to a garage. Modern technology has made this simple, with mobile apps that can pinpoint your exact location.

What is the process for making a claim?

Getting help is easier than ever. Most providers offer a few ways to request assistance.

-

Calling the helpline is the traditional method, with 24/7 phone numbers available for emergencies.

-

Using a mobile app has become very popular. Many provider apps let you request assistance with a few taps and use your phone’s GPS to automatically identify your location, sending it directly to the rescue team.

-

Online portals offer a third option, accessible from any smartphone browser.

When you make contact, you’ll need to provide your membership number, location, vehicle details, and a description of the problem. The more specific you are, the better prepared the technician will be. The provider will then dispatch help and give you an estimated arrival time.

Frequently Asked Questions about Motorcycle Breakdown Assistance

We understand that riders often have specific questions when considering motorcycle breakdown cover. Here are some of the most common concerns.

Am I covered if I’m riding as a pillion passenger?

This depends on your policy type. If you have personal cover, then yes, you are covered as an individual, even when riding as a passenger on someone else’s motorcycle. However, if your policy is vehicle cover for a specific bike, the coverage stays with that bike, and you would not be covered as a passenger on a different motorcycle.

Does breakdown cover include mopeds and scooters?

Yes, typically motorcycle breakdown cover extends to mopeds and scooters. However, there might be minimum engine size requirements, such as being over 49cc. The vehicle must also be road-legal with proper registration and insurance to qualify. It’s always best to verify with your chosen provider that your specific model is covered.

Is there a waiting period before I can make a claim?

Yes, in most cases, there is a waiting period before your motorcycle breakdown cover becomes active. This is standard practice to prevent people from buying cover only after they’ve already broken down.

Typical waiting periods range from 24 to 72 hours after purchasing the policy. This means you generally cannot purchase breakdown cover immediately after your bike has an issue and expect it to apply to that incident. The lesson is to plan ahead and purchase your cover before you need it.

Conclusion

Motorcycle breakdown cover is an essential tool that provides peace of mind on the open road. Nothing kills the joy of a ride quite like being stranded with a mechanical issue and no help in sight.

We’ve walked through the different types of cover, from basic roadside assistance to comprehensive plans with national recovery and home start. We’ve also clarified the difference between personal cover (which follows you) and vehicle cover (which sticks with your bike), helping you choose what makes sense for your riding habits.

Understanding costs, exclusions, and the crucial distinction between breakdown cover and motorcycle insurance is key. One gets you moving after a mechanical failure; the other protects you financially from accidents and theft. You need both.

Traditional motorcycle breakdown cover often involves annual memberships and waiting periods. At Road Rescue Network, we’ve reimagined roadside assistance. We offer on-demand help when you need it—no membership fees, no long-term contracts, and no waiting periods. You get instant access to local rescuers, 24/7, with transparent, pay-per-use pricing.

We’re available across major cities throughout the US. When your bike has an issue, we connect you instantly with qualified local professionals who can get you back on the road fast.

As you plan your next ride, think about your breakdown protection. It’s an investment that seems unnecessary until the moment you desperately need it. Choose wisely, ride confidently, and know that help is always within reach.